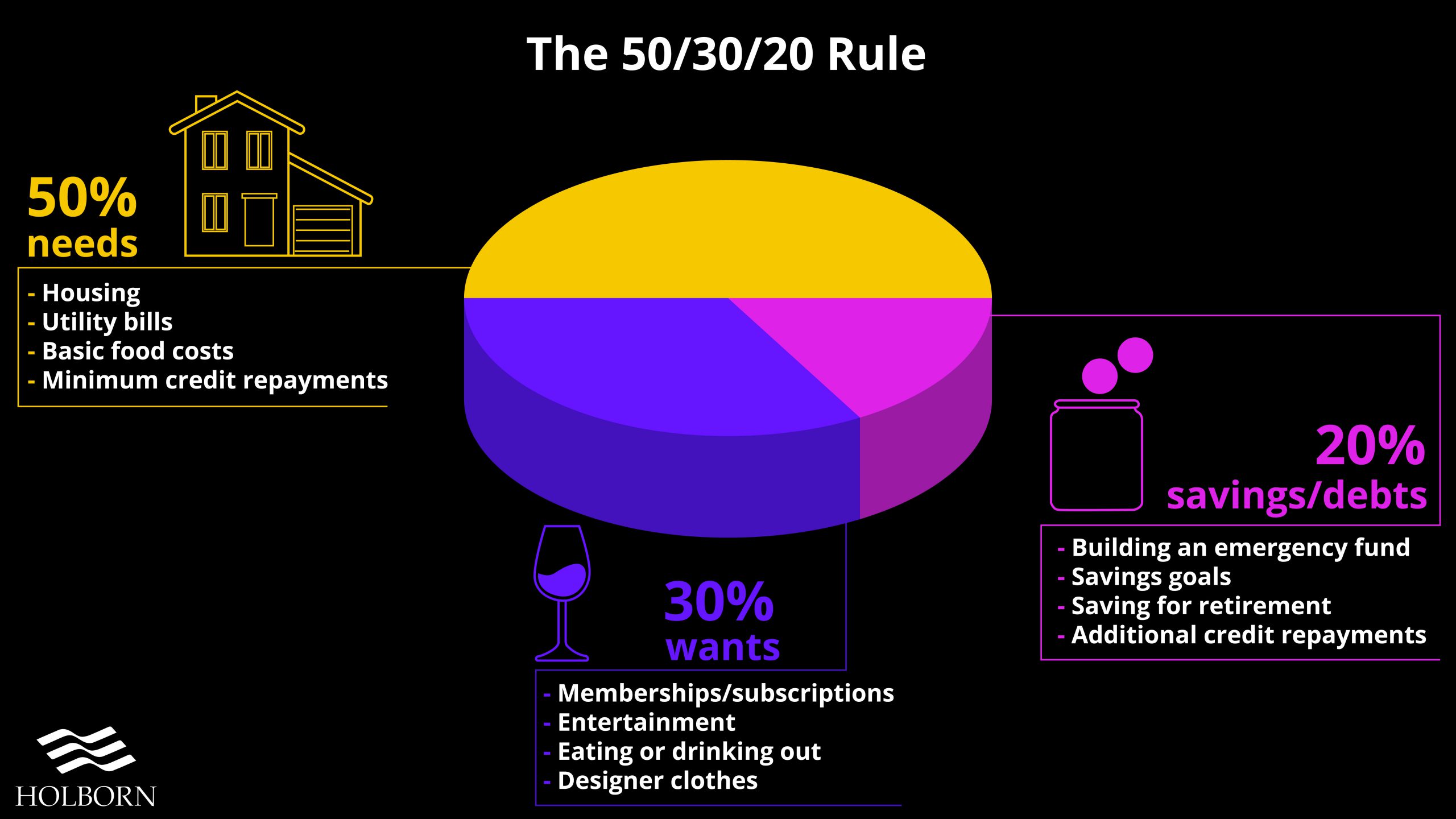

Utilities like electricity bills, water bills, etc.Īs per this rule, half of your post-tax income is used for a basic standard of living with all the obligations to take care of.Some of these expenses include the following – Thus, your needs dominate the expenditure bucket, and you cannot live without them. The basic requirements of food, shelter and clothing fall in this category. Needs are the basic expenses that you absolutely require for your living. Let’s look in detail at what the 50/30/20 rule of budgeting rule looks like – 50% for Needs Instead, using this rule, you can balance your money across needs, wants, and savings.

This book concludes that you don’t need a complicated budget to get your finances in check. Senator Elizabeth Warren in the US wrote a book in 2005 titled “All Your Worth: The Ultimate Lifetime Money Plan”. Also, it helps to reach your financial goals by saving more.

In other words, it helps to build a structured spending habit. Also, with only three major categories, you can save yourself from the time and stress of understanding the details every time you spend. This rule helps to keep your expenses balanced across the main spending areas and put your money to work more efficiently. Use Income Tax Calculator to calculate your post-tax income. This is not a hard and fast rule but a simple guideline that helps you build a financially strong budget. This basic thumb rule is to divide your post-tax income into three spending categories – 50% for needs, 30% for wants, and 20% for savings. The 50/30/20 rule of budgeting is a simple method that helps you manage your money more effectively.

0 kommentar(er)

0 kommentar(er)